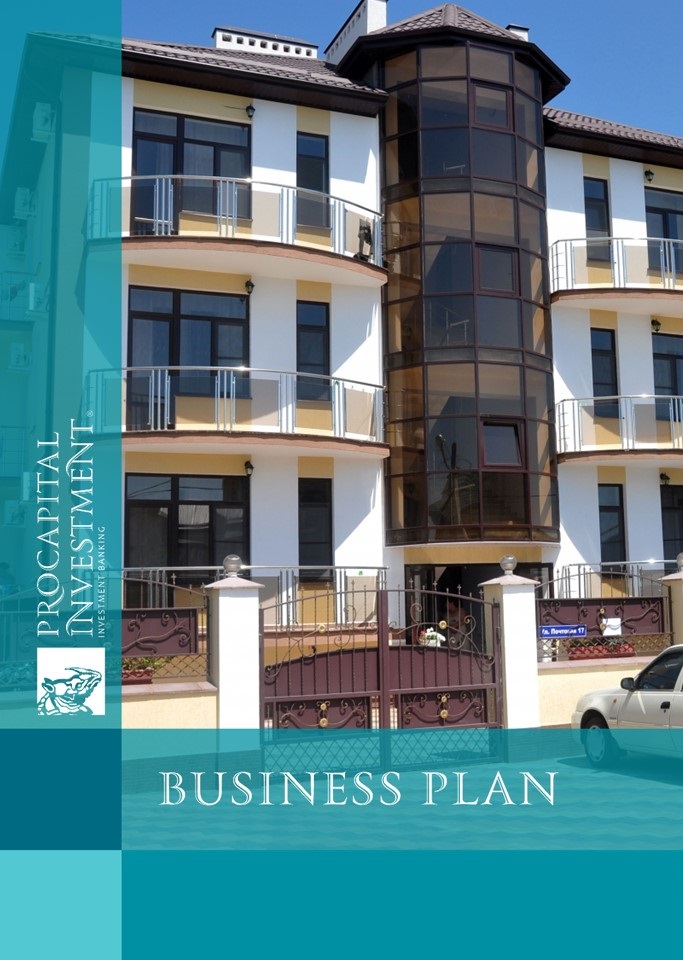

Business ideas for small business in Ukraine. Opening a mini hotel of economy class

General characteristics

| Date of Preparation: | April 2014 year |

| Number of pages: | 27 pages, including 14 applications, 14 tables, 9 figures (document prepared in Russian) |

| Payment method: | prepayment |

| Production method: | digital Word + financial model in Excel |

16999 UAH

- This project can be updated with your volumes, period and location

- You can order business plan for other project - сontact us

- You can also order market research for your business

The concept of the project:

The project envisages construction of a mini hotel of economy class for a family vacation during summer time.

Hotel will be built on a land plot with the total area of 10 hundred square metres in the southern region of Ukraine – Odessa region.

Development of this investment document should help the future project initiator to evaluate the main parameters and functioning characteristics of a mini hotel, as well as rationality, economic, and social benefits from the project.

A developed business plan consists of two main complementary parts – calculations and description which reveal investment attractiveness of the future project, profitability and efficiency of investment funds in construction of a mini hotel in the southern region of our country.

A business plan contains a detailed list and description of the main assets of the project, required equipment, characteristic of organizational process, as well as information about required staff, permits, etc.

Calculations of a developed business plan disclose information about the total cost of the project and direction of investment funds, as well as a schedule of funding for its implementation. A financial model includes a sales plan for the project, profits and losses statement, cash flow statement, calculated profitability indices, profitability and investment attractiveness of the project, and breakeven point in natural and monetary terms. In addition, the financial model contains a lot of graphic information, interpreting obtained financial results.

A developed business plan contains a SWOT-analysis of the project – information about its strengths and weaknesses, as well as opportunities and external threats.

Content:

1. PROJECT SUMMARY

2. PROJECT DESCRIPTION

2.1. Project concept. Description of business idea

2.2. Location of the project

2.3. Description of manufacturing process. Equipment and assets

2.4. Necessary staff

3. FINANCIAL ASSESSMENT PROJECT

3.1. Parameters of the project

3.2. Initial data for the calculations and their reasoning

3.3. Sources of the project financing. Target areas of investment and investment schedule

3.4. Revenue forecast for the project

3.5. Statement of revenues and expenditures

3.6. Statement of cash flows for the project

3.7. The break-even point for the project

3.8. Evaluation of investment attractiveness and profitability of the project: NPV, IRR, DPP, PI and other

4. RISK ANALYSIS OF THE PROJECT

4.1. SWOT-analysis

5. CONCLUSIONS

Applications:

Appendix 1. Aggregates for project

Appendix 2. Project settings

Appendix 3. Sources of financing and the total cost of the project

Appendix 4. Capital costs for the project

Appendix 5. Project schedule

Appendix 6. Calculation of depreciation on the project

Appendix 7. Staff of the project

Appendix 8. Sales forecast plan for the project

Appendix 9. Forecast of profit and loss statement for the project

Appendix 10. Forecast of cash flows for the project

Appendix 11. The scheme operating costs for the project

Appendix 12. Profitability analysis of project

Appendix 13. Calculation of break-even point for the project (in-kind and cash equivalents)

Appendix 14. The calculation of project performance indicators

List of Tables:

Table 1. Summary of project

Table 2. Staffing of the project

Table 3. General parameters of the project

Table 4. Parameters of the mini-hotel functioning

Table 5. Project's taxation parameters

Table 6. Project's investment expenditures

Table 7. Schedule of investing and implementation of the project

Table 8. Scheme of project revenues

Table 9. Profit and Loss report of the project

Table 10. Formation of project profit

Table 11. Project profitability

Table 12. Operating expenses of the project

Table 13. Break-even point of the project

Table 14. Project performance indicators

List of graphs and charts:

Figure 1. Location of the project

Figure 2. Structure of investment expenditures of the project

Figure 3. Schedule of financing and implementation of the project

Figure 4. Formation of project profit

Figure 5. Gross revenue and gross margin of the project

Figure 6. Net income and return on sales of the project

Figure 7. Structure of operating expenses of the hotel

Figure 8. Internal rate of return of the project

Figure 9. Discounted payback period of the project