Ukraine can market expected to grow in 2025 - comments by Pro-Consulting CEO Oleksandr Sokolov. THE CANMAKER

Ukranian canmaking sector slowly developing these days

The Ukranian canmaking sector is slowly developing these days despite the ongoing war with Russia, which led to the loss of about 18% of territories and the overall tough business environment in the country.

This is reflected by the ever growing demand for aluminium cans both from leading local drinks’ producers and customers. In addition, as Ukraine switches on EU standards of packaging these days, the use of aluminium cans by local business is increasing in contrast to plastic and other alternatives.

According to some independent analysts, the market has good prospects for growth in 2025 although much will depend on the further economic situation in the country and future dynamics on battle line.

Harshita Mitra, research analyst at Euromonitor International in an exclusive interview told the metal cans market in Ukraine is poised for growth in 2025, driven by increasing demand across food and beverages, and consumer goods, taking into account environmental issues, while these trends are expected to be observed throughout the entire 2025.

Harshita Mitra comments:

« In response to rising environmental concerns and consumer demand for eco-friendly solutions, Ukraine has embraced sustainable packaging innovations since 2023. With Europe implementing restrictions on single-use plastics and consumer awareness at an all-time high, many beverage brands are shifting towards environmentally sustainable packaging».

In the meantime, major Ukranian drinks’ producers as well as global companies, operating in the local market, are increasing the use of aluminium cans in their manufacturing processes as well as day-to-day operations these days.

According to analysts and some Ukranian media reports, in 2023-2024, some leading local brands in the alcoholic drinks industry such as Obolon have transitioned to using recycled aluminium cans. In addition to reduction of carbon footprint, the use of recycled cans also allowed Obolon, which is one of the largest beer and soft drinks’ producers in Ukraine to significantly reduce its production costs. Representatives of the company were not available for comments.

Despite the ongoing hostilities, the development of the segment of can recycling is ongoing in Ukraine, being primarily observed in the largest cities of the country including Lviv, Kharkiv and the Ukranian capital the city of Kiev, where numerous collection points for aluminoum cans have been established in recent years.

Harshita Mitra and other analysts believe the demand for aluminum cans will continue to grow in Ukraine in years to come, that will be correlated regulations like the EU's Single-Use Plastics Directive, adopted in 2019, which encourages the use of sustainable alternatives such as metal cans. That will contribute to the more active replacement of plastic packaging in Ukraine by aluminium cans in the coming years.

For 2025, most of analysts expect about 15% of plastic packaging will be replaced in Ukraine by sustainable solutions that comply with the EU’s Packaging and Packaging Waste Regulation (PPWR). A significant part of this volume will account for aluminium cans.

In the meantime, for global canmakers and their major customers – beer and soft drinks’ producers – the expansion into the Ukranian market is considered among the priorities, given a significant cut of their presence in Russia in recent years.

Ukrainian brands are also playing a significant role in this transformation. For instance, in 2025, CANPACK collaborated with IDS Ukraine, Ukraine’s major producer of mineral water, which is part of IDS Borjomi International holding - to produce 330ml aluminium cans for its flagship Morshynska's all-natural lemonades range in aluminium beverage cans.

According to the company, these beverages combine Morshynska's natural mineral water with real fruit juices and are free from preservatives, artificial colorings, and flavourings. The available flavours include apple, orange-peach, and grapefruit.

Another example is Lviv Brewery, part of the Carlsberg Group in Ukraine. In 2024, the brewery launched its seasonal beer, Lvivske Rizdvyane, in special edition cans produced by CANPACK using their Duomix print technology. According to the company, this innovative approach not only allowed to enhance the visual appeal of the product but also aligns with the sustainability trend.

Representatives of Canpack declined to comment.

Analysts of Euromonitor International believe with such initiatives and the broader shift towards eco-friendly packaging across Europe, the demand for metal beverage cans in Ukraine is expected to grow steadily in 2025 and in the years to follow. Still the rates of expected growth are unclear, which is also due to the loss of a significant part of industrial potential by Ukraine, given that most of it had been historically located in its eastern part.

Still, among the major problems, which may prevent the expected growth is an active shortage of workers in the country and the existing generally high level of corruption.

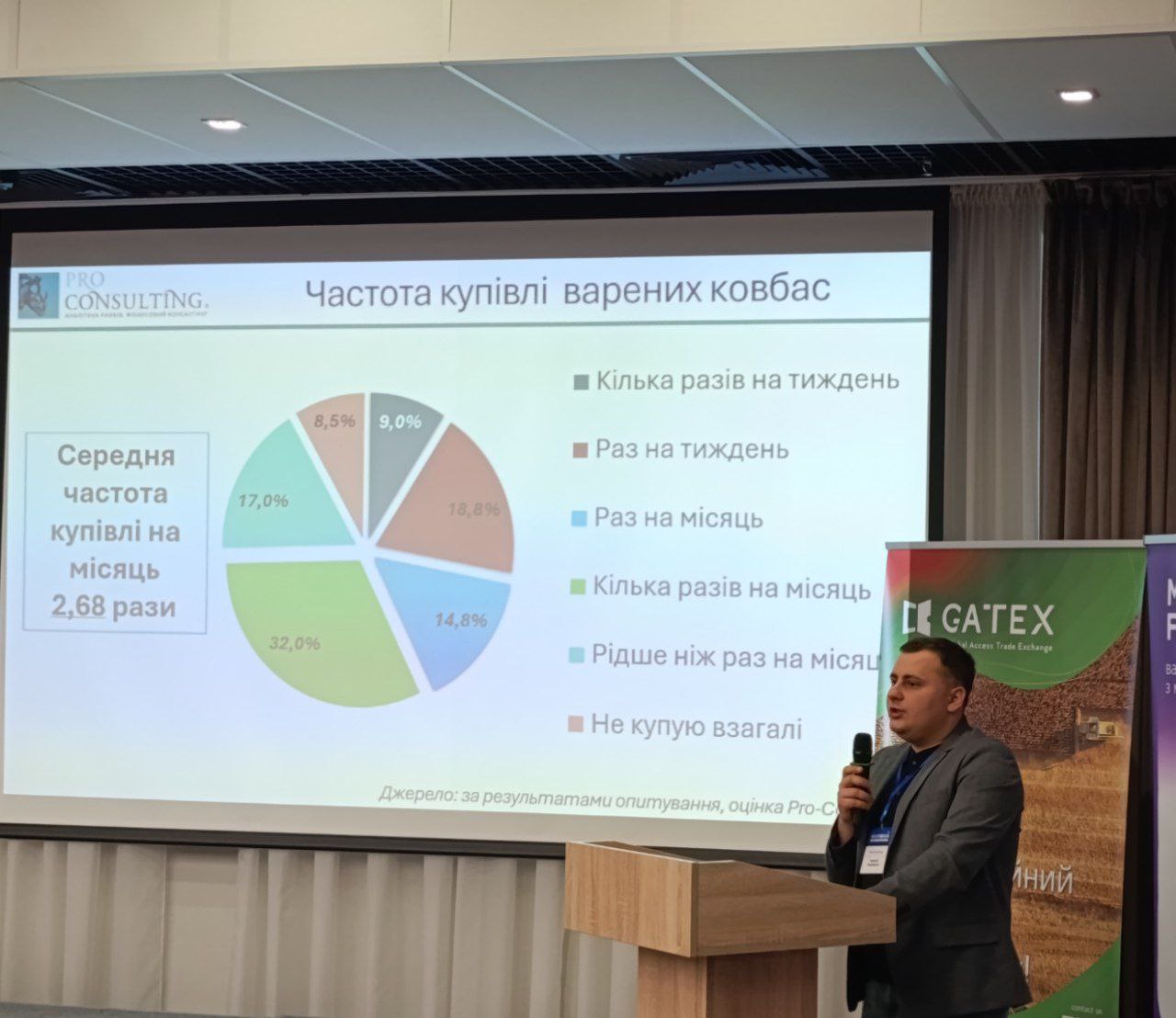

Also, according to Oleksandr Sokolov CEO of - Pro-Consulting, one of Ukraine’s leading research agencies in the field of finance and canmaking, in an exclusive interview told currently the aluminum can market of Ukraine is undergoing a period of recovery until 2021 levels.

Oleksandr Sokolov comments:

«As of 2024, its capacity is 85% of the 2021 level. In 2021, the market was estimated at US$76.31 million, and sales volume was approximately 1 billion cans at an average price of an imported can of 7 cents. As a result of the crisis, the market decreased by 43% and reached a minimum of $43.29 million. However, since 2023 and 2024, positive dynamics have been observed, while in 2024 the market reached $65.21 million, which is 50% more than in 2022».

At the moment, the share of imported products in the market is approximately equal to the volume of domestic production. This is due to the shortage of raw materials and limited production capacity, which does not allow Ukrainian enterprises to fully meet demand, while the same situation was observed prior to 2022.

As Sokolov expects, the market capacity will grow in 2025, that will be mainly due to the increase in the volume of markets for goods that use aluminum containers, in particular the market for beer and sweet carbonated drinks of Ukrainian production. According to forecasts, their production will grow by 5% and 7%, respectively.

The increase in the average price of an imported can in Ukraine in 2024 from 7 to 9 cents compared to 2021 was due to the ban on imports of products from Russia, which in 2021 accounted for a third of total imports, and its average price was 5 cents per can.

The main manufacturer-importer on the Ukrainian market is Can-Pack, which occupies about 60% of the total market capacity. The second place is occupied by Ardagh Metal Packaging, whose market share is 15%. It is currently the leading importers and supplier cans to the largest Ukrainian manufacturers of low-alcohol beverages.

Another foreign exporter, CROWN BEVCAN SLOVAKIA, is in third place, with a market share of approximately 8%. This company also supplies its products to the largest beverage manufacturers in Ukraine.

In fourth place is the Ukrainian manufacturer Technocap UA, a company with foreign capital. Technocap specializes in the production of aluminum containers for household products and occupies about 6% of the market. Despite the growth in imports, the share of Ukrainian manufacturers remains limited due to the shortage of raw materials and insufficient production capacity.

Another major player is Novelis. As Nicole von der Roop, an official spokeswoman of the company told in an exclusive interview, the company operates in Ukraine, although it does not deliver directly to Ukraine.

Nicole von der Roop comments:

«We´re delivering material to one of our clients based in Ukraine (Kiev) via the Karpiel terminal in Brzesko, Poland. From there it is then sent to Ukraine by our clients directly».

Source: THE CANMAKER