Online casino market research in Ukraine, Belarus, Moldova, Georgia, Armenia. 2020 year

| Date of Preparation: | November 2020 year |

| Number of pages: | 101, Arial, 1 interval, 10 point |

| Graphs and charts: | 10 |

| Tables: | 9 |

| Payment method: | prepayment |

| Production method: | e-mail or courier electronically or in printed form |

| Report language: | ukrainian, russian, english |

- This report can be updated and customized based on your business goals; you can also purchase part of report (no less than 50%) at a more affordable price

- Failed to find your market research report? - contact us

- You can also order feasibility study and business plan for your business idea

Summary of the market analysis:

Pro-Consulting has conducted a survey of the gambling market in the CIS countries.

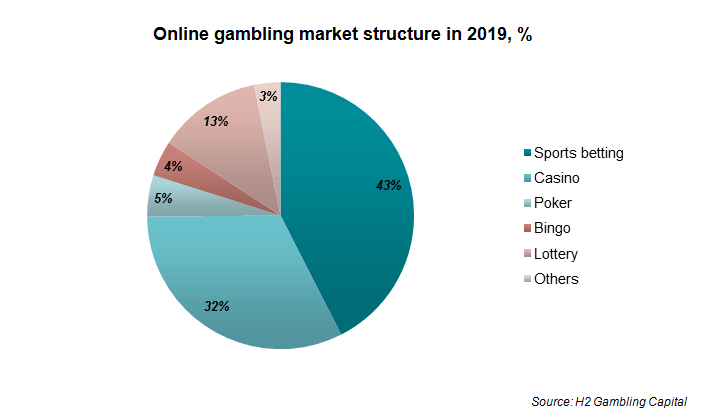

In 2019, the largest share falls on sports betting - 42.5%, the next position behind casinos - 32.4%, and poker closes the top three most popular gambling activity with a share of 5.0%.

Analysis of the gambling market showed that the average gambler is a gambler at the age of 30. This pattern is based on the fact that by this age the player receives a stable income and has the appropriate computer skills, while also using mobile devices.

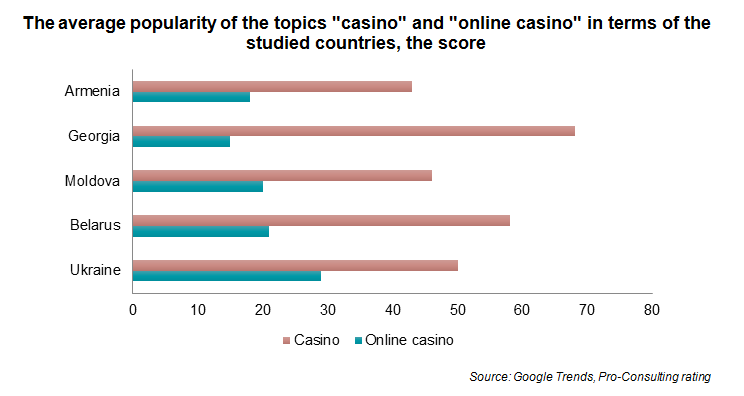

Using the Google Trends tool in the gambling market, the popularity of the topic "casinos" and “online casinos" by country is presented below.

Requests are assigned points from 0 to 100, where 100 points mean the location with the highest share of the request's popularity, 50 points - the location, the level of popularity of the request in which is half that of the first. 0 points means a location for which there is insufficient data on the request in question.

The average popularity of the topic “casinos” and “online casinos” in the context of the studied countries singles out Georgia, Belarus and Ukraine as countries with a high interest in gambling.

In Moldova and Armenia, demand is lower due to the state policy pursued.

Focusing on the market leader in gambling means choosing the most effective experience in managing board games, optimizing revenue, selecting the right products, creating your own winning animations.

Creating a gambling site is similar to creating other sites. However, there are some difficulties.

First of all, it is necessary to determine what kind of online games will need to be promoted. The main interest is to get quality traffic.

A huge layer of work belongs to SEO. You need to link to the site correctly because of the competition. Most large online casinos offer affiliate programs.

Recommendations for market development:

1. Convince visitors of the reliability and ease of replenishment of the deposit and withdrawal of funds;

2. Create a greeting package that can interest site visitors;

3. Create support 24/7;

4. Offer to play including demo versions of games

5. Use advertising and social networks as soon as possible, while making the site accessible to search engines.

Since casinos are highly dependent on the customer base, market orientation and knowledge of consumer motives are key aspects in the further development of the market.

Detailed contents:

1. General characteristics of the online casino market. (Requires legal advice)

1.1. State regulation of the online casino industry (by country)

1.1.1. The basic laws governing the industry (list, brief summary and features of the laws)

1.1.2. Specifics in the availability of a license for conducting gambling activities

1.1.3. Market taxes and fees

- general business taxation

- legality and current status

- legislation on methods of depositing and withdrawing funds (the ability to replenish an account through wallets)

- prospects for legislative changes

- regulation of advertising

1.2. Analysis of trends in the online casino market development in 2018 - 1st half 2020 in Ukraine, Belarus, Moldova, Georgia and Armenia (history of development, specifics, problems, factors of influence on the market)

1.3. General indicators of the online casino market, calculation of market capacity in 2018 – 1 half 2020 (estimate; by country)

- Potential market capacity

- Target market volume

- Achievable market volume

1.4. Segmentation and structuring of the market – highlighting of online casinos share from the total volume. (by country in the open source monitoring format)

2. The target audience

2.1. Consumer preferences regarding online casinos, consumer profile

2.2. Consumption segmentation and structuring (based on desk research data):

- by the financial wealth of the consumer

- by service features

2.3. Search ads analysis by specified queries types in Google (competitor ads, analysis of distinctive features)

3. Competitor analysis

3.1. List, segmentation and structuring of the major market operators

3.2. Competitors’ promotion analysis (used advertising methods and image elements, commercials, non-standard solutions). Sources of customer acquisition (online)

3.3. Major operators market shares in 2018–1 half 2020 – assessment (by country)

4. Conclusions.

4.1. Forecast trends and indicators of market development in 2020-2023. Building a multifactorial model based on the degree of influence of identified factors during research

4.2. Market development recommendations

5. Investment attractiveness of the industry

5.1. SWOT, PEST – market direction analysis

5.2. Market development risks and barriers. Building a risk map in the market (updating and changes)

List of Tables:

1. Licensing requirements in accordance with the Law of the Republic of Armenia "On Licensing"

2. The potential volume of the online casino market in 2018 is 1H 2020, USD million

3. Online casinos target market volume by country in 2018 - 1H 2020, USD million

4. The volume of the achievable online casino market by country in 2018 - 1st half 2020, USD million

5. Submitted ads with the highest display frequency on Google

6. Forecasting trends in the development of the online casino market in 2020-2023, USD million

7. SWOT- gambling market analysis

8. PEST- gambling market analysis

9. Risk ranking of the gambling market development

List of graphs and charts:

1. Online gambling market structure in 2019,%

2. The dynamics of "casino" and "online casino" topics popularity by country for 2018-1 half 2020, p.

3. Popularity by sub-regions of "casinos" and "online casinos" topics in Ukraine for the period 2018-2020, %

4. Average number of "casino" and "online casino" topics popularity in the context of the research countries, points

5. Traffic sources for the largest casinos in the researched countries

6. Slotokingua.com Total Visits in Apr-Sep 2020, thous. Visits

7. Average dynamics of organic traffic shares for Russian-speaking users in the researched countries in 2019

8. Largest casinos’ traffic sources in the researched countries

9. Major operators share among all requests in 2018 -1 half 2020 by country, %

10. Forecasting trends in the development of the online casino market in 2020-2023, USD million.